Oops! Something went wrong with the browser.

Please try again. If the issue persists, contact support@logicimtech.com and include error code .

Logicim's ready-to-use Sage 50 departmental income statement

Departmental income statement

A Departmental income statement Report enables you to compare multiple departments’ income statements over a given period.

Prerequisite

- Logicim XLGL version 5.0 or higher

- Microsoft Excel 2016 or higher

- Sage 50 Canadian Edition (2014 and above)

What the Report does

This Report is useful when you compare income statements per department. It also has the budget and variance functionality, which is computed automatically.

How to use the Report

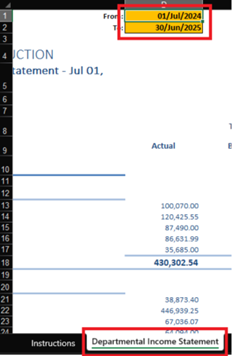

- Enter your From and To date in cells D1 and D2 on the Departmental income statement worksheet.

- Notice that the value changes once you have changed the dates.

Common use cases

This Report saves you time by providing a side-by-side analysis of income statements per department through your specified date range. This is particularly great when you also see the budget allotted for that department and the variance from the actual values. Values unassigned in a department are also included in the Report.

Troubleshooting

- Issue: No values appear on the worksheet.

- Solution 1: Ensure the From date doesn’t surpass the To date.

- Solution 2: Ensure your account has the necessary permissions to access the Accounts & General Ledger.

FAQs

- Q: I see a lot of departments in the Report. Can I reduce the number of departments?

- A: Yes, you can! You may hide the departments you don’t want to see, like a spreadsheet.

Choose the department columns. Right-click on any part of the highlighted cells and then click Hide.

Best practices

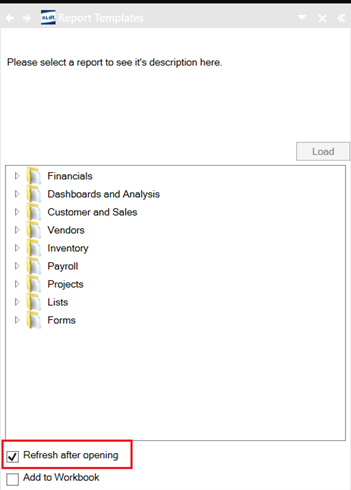

Connect with the right company before loading this Report. Ensure that the Refresh after opening checkbox is checked for an accurate company, which will save you some steps, like clicking the Refresh button on the XLGL ribbon.

Related articles

Edited: Thursday, June 12, 2025

Was this article helpful?

Thank you! Your feedback matters.